Open the Conveniences: Offshore Count On Solutions Described by an Offshore Trustee

Offshore count on solutions have come to be increasingly preferred amongst individuals and businesses looking for to optimize their monetary methods. In this interesting guide, we explore the world of offshore counts on, supplying an extensive understanding of their advantages and just how they can be successfully made use of. Written by an overseas trustee with years of experience in the field, this source offers important insights and professional suggestions. From the fundamentals of overseas depend the intricacies of tax obligation preparation and asset protection, this overview checks out the various benefits they use, consisting of improved personal privacy and privacy, versatility and control in riches monitoring, and accessibility to global financial investment possibilities. Whether you are a seasoned investor or new to the idea of offshore trusts, this overview will certainly furnish you with the expertise needed to unlock the advantages of these powerful economic tools.

The Fundamentals of Offshore Trusts

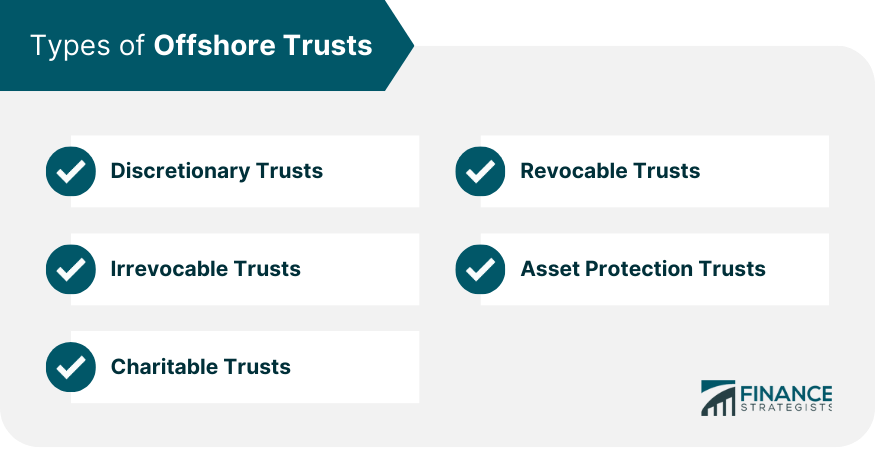

The basics of overseas depends on include the establishment and administration of a depend on in a territory beyond one's home nation. Offshore counts on are usually utilized for asset protection, estate preparation, and tax optimization objectives. By placing assets in a count on located in a foreign territory, individuals can ensure their assets are secured from prospective threats and obligations in their home nation.

Establishing an offshore count on typically requires involving the solutions of a specialist trustee or trust fund business who is skilled in the laws and regulations of the selected territory. The trustee acts as the legal proprietor of the assets held in the trust while handling them in accordance with the terms laid out in the count on act. offshore trustee. This plan gives an included layer of security for the assets, as they are held by an independent third event

Offshore depends on supply several benefits. They can offer improved personal privacy, as the information of the count on and its beneficiaries are commonly not publicly revealed. They supply prospective tax benefits, as specific jurisdictions might have extra favorable tax programs or supply tax exceptions on specific types of revenue or possessions held in trust fund. Finally, overseas depends on can help with effective estate planning, allowing people to pass on their wide range to future generations while reducing inheritance tax obligation liabilities.

Tax Obligation Preparation and Asset Defense

Tax preparation and property defense play a critical function in the calculated application of overseas depends on. Offshore depends on provide individuals and businesses with the possibility to reduce their tax obligation liabilities legally while protecting their properties. Among the primary benefits of utilizing overseas trust funds for tax obligation planning is the ability to benefit from desirable tax programs in international territories. These jurisdictions frequently provide reduced or absolutely no tax prices on specific kinds of earnings, such as funding gains or dividends. By establishing an offshore count on among these people, organizations and territories can considerably reduce their tax obligation worry.

Possession security is an additional crucial aspect of overseas trust services. Offshore trust funds offer a robust layer of protection versus prospective risks, such as legal actions, lenders, or political instability. By transferring assets into an overseas trust fund, people can shield their wide range from potential legal cases and guarantee its conservation for future generations. In addition, offshore trust funds can use discretion and personal privacy, more protecting assets from prying eyes.

Nevertheless, it is essential to note that tax preparation and possession security ought to always be performed within the bounds of the legislation. Taking part in illegal tax obligation evasion or illegal possession security techniques can result in severe effects, consisting of penalties, fines, and damage to one's track record. As a result, it is important to seek specialist recommendations from seasoned overseas trustees who can direct people and businesses in structuring their offshore counts on in a moral and certified way.

Boosted Personal Privacy and Discretion

Enhancing privacy and privacy is a paramount goal when making use of overseas count on services. Offshore trusts are renowned for the high degree of personal privacy and discretion they supply, making them an attractive option for services and people looking for to shield their properties and monetary info. Among the essential advantages of offshore trust solutions is that they give a lawful structure that permits people to keep their monetary affairs personal and secured from prying eyes.

The boosted privacy and confidentiality check over here provided by offshore trust funds can be particularly beneficial for individuals that value their personal privacy, such as high-net-worth people, celebs, and professionals seeking to shield their properties from possible claims, lenders, or perhaps family disagreements. By making use of overseas count on solutions, people can keep a higher level of personal privacy and confidentiality, enabling them to secure their riches and financial rate of interests.

Nevertheless, click here for info it is necessary to note that while overseas counts on provide enhanced personal privacy and confidentiality, they have to still abide by relevant laws and laws, including anti-money laundering and tax obligation reporting demands - offshore trustee. It is crucial to collaborate with trusted and experienced legal professionals and offshore trustees who can make sure that all legal responsibilities are met while taking full advantage of the personal privacy and privacy advantages of offshore count on services

Flexibility and Control in Wealth Monitoring

Offshore depends on supply a significant degree of adaptability and control in riches management, enabling companies and people to efficiently manage their possessions while keeping personal privacy and privacy. One of the essential advantages of offshore depends on is the capability to tailor the count on framework to fulfill certain needs and goals. Unlike conventional onshore trust funds, offshore trust funds provide a large range of options for possession security, tax obligation preparation, and sequence planning.

With an offshore trust, services and individuals can have greater control over their wealth and how it is handled. They can choose the jurisdiction where the trust fund is developed, permitting them to take benefit of beneficial legislations and regulations. This versatility allows them to enhance their tax obligation placement and shield their possessions from potential risks and liabilities.

Additionally, overseas depends on use the option to assign professional trustees that have considerable experience in taking care of complex counts on and browsing global policies. This not just guarantees effective riches administration but likewise provides an additional layer of oversight and security.

In addition to the flexibility and control supplied by use this link overseas trusts, they also offer privacy. By holding assets in an overseas jurisdiction, companies and individuals can protect their financial details from prying eyes. This can be especially valuable for high-net-worth individuals and companies that value their personal privacy.

International Investment Opportunities

International diversification gives individuals and companies with a wide variety of investment opportunities to broaden their profiles and reduce risks. Buying worldwide markets allows financiers to access a wider series of asset courses, industries, and geographical regions that may not be readily available locally. By diversifying their financial investments throughout various nations, capitalists can lower their direct exposure to any type of solitary market or economic situation, therefore spreading their threats.

One of the crucial advantages of global investment opportunities is the possibility for higher returns. Different nations might experience varying economic cycles, and by buying numerous markets, financiers can take advantage of these cycles and possibly accomplish higher returns contrasted to spending entirely in their home country. In addition, investing globally can also provide access to arising markets that have the possibility for rapid economic development and higher financial investment returns.

Furthermore, global investment chances can supply a hedge against currency danger. When buying international money, financiers have the prospective to gain from currency fluctuations. For example, if a financier's home currency deteriorates versus the money of the foreign financial investment, the returns on the investment can be intensified when transformed back to the investor's home money.

Nevertheless, it is essential to keep in mind that investing worldwide likewise comes with its very own collection of dangers. Political instability, regulative changes, and geopolitical unpredictabilities can all affect the efficiency of international financial investments. Consequently, it is critical for financiers to perform thorough research study and look for professional suggestions prior to venturing into global investment chances.

Verdict

The essentials of overseas trusts entail the facility and administration of a trust in a territory outside of one's home nation.Establishing an overseas count on commonly requires engaging the solutions of a professional trustee or trust business that is fluent in the legislations and policies of the selected jurisdiction (offshore trustee). The trustee acts as the lawful proprietor of the assets held in the trust while managing them in accordance with the terms established out in the count on act. One of the vital advantages of overseas trust funds is the capability to tailor the depend on framework to satisfy particular requirements and goals. Unlike standard onshore counts on, offshore counts on provide a broad variety of choices for asset defense, tax obligation planning, and succession planning